Category: Banking

-

World Bank: Nigeria Retains Its Position as Africa’s Largest Economy

Nigeria continues to hold its position as Africa’s largest economy, reaffirmed by the latest World Bank report. Despite facing inflation, currency fluctuations, and investment hurdles, the country’s vast population, resource wealth, and booming digital economy provide a strong foundation for growth. Foreign investments, particularly in telecommunications and infrastructure, are driving…

-

Zimbabwe’s Currency: History and Uncertain Future

Imagine prices doubling or tripling within hours. That’s the grim reality Zimbabwe faced in 2008, a country grappling with the world’s highest hyperinflation (a staggering 79 billion percent!) and a collapsing currency. But how did this once-promising nation end up with a seemingly worthless piece of paper in its wallet?…

-

Why Nigerians Can’t Fully Embrace PayPal and What Can Be Done

Nigeria’s financial tango with PayPal has left many pondering the limitations on receiving money. Regulations, infrastructure gaps, and fraud concerns are at play. While Nigeria is striving to modernize its financial landscape and address fraud, collaboration between stakeholders is key. Ensuring equal access to the global market is imperative for…

-

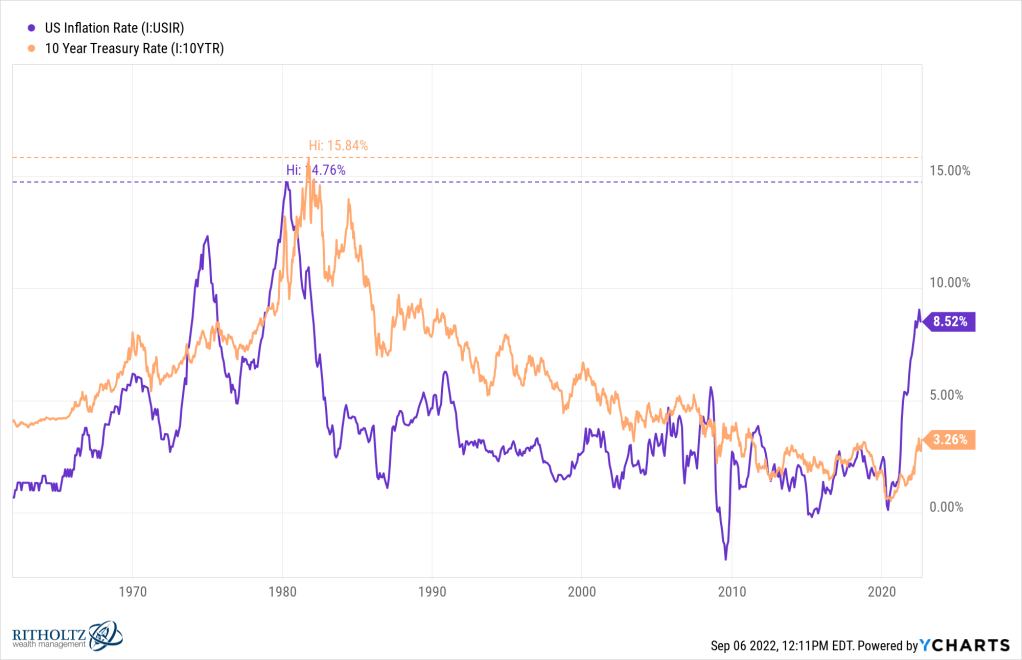

Why Do Interest Rates Go Up When Prices Do?

Central banks, like the US Federal Reserve, aim to maintain stable prices and employment. When inflation rises, they raise interest rates to reduce borrowing and spending, curbing inflation. However, this can also slow economic growth and lead to higher unemployment. It’s a delicate balance, but crucial for a healthy economy.

-

Fintech Boom in Nigeria: Opportunities for Nigerian Youths

In 2021, Nigeria emerged as a powerhouse in Africa’s fintech landscape, with its fintech startups raising an astounding $1.4 billion in funding. This figure accounted for more than half of the total funding secured by African fintech startups during the same year. The rapid growth of Nigeria’s fintech sector can…